Expenses and costs are similar concepts. Sometimes, they can even be utilized interchangeably. However, business owners should consider some differences between these two terms.

Expenses refer to ongoing needs, such as rent in a retail area, something that you can cover with secured loans online or employees’ salaries whereas costs are prices paid to get an asset. In this article, we are going to talk about the difference between costs and expenses and in what situations you should use certain terms.

Is There a Difference Between Costs and Expenses?

Although these terms are similar and may be used interchangeably, they can also differ in their meanings. The main difference is that expenses mean the consumption of the necessary items while costs determine expenditures. People who are going to be accountants may sometimes have difficulties understanding what these terms actually mean and how to differentiate them. Why is a cost often considered an expense?

It happens as most types of expenditures are consumed straight away. In this case, costs transform into expenses immediately. It often happens with expenditures connected with a certain period, such as rent, administrative salaries, office supplies, or monthly utility bills. Even in accounting terminology, these terms can be utilized interchangeably.

It may be necessary to distinguish the difference for small business owners who want to understand if their venture is doing well and bringing profit. When your costs and expenses exceed your earnings, you may look for secured loans online to fill a money gap and receive extra funds for your needs. Secured loans can be used for personal and business expenses.

Sometimes, using payday apps for instant loan can be beneficial if you want to get additional money on the go. A payday app allows borrowers to apply for and obtain money at any time in several clicks right from their smartphone. The amount withdrawn from an app isn’t large compared to secured loans but it can help consumers with small financial disruptions.

Definition of Expense

Expenses are costs whose utilities have been consumed or used up. For instance, the $50 item will be charged to the cost of products sold when it is finally sold. In the same way, the $50,000 car you bought will later be charged to expense through depreciation within a few years. Speaking of the $50 item, transforming from an asset to an expense is received with a credit to the inventory account and a debit to the cost of products sold.

Speaking of the second example, this transformation is accomplished with a credit to the accumulated depreciation account and a debit to the depreciation expense account. Besides, you may consider that an expense is a type of expenditure made in order to gain profit under the matching method.

Definition of Cost

This term is more equal to the term expenditure. It means you want to obtain something and have expanded your resources to achieve it. The required item may have already been consumed or not. Until this item is consumed, it is considered an asset. Inventory, prepaid expenses, and fixed assets are examples of assets into which bought items are recorded.

For instance, the cost of a car can be $50,000 and the cost of a product you made is $50. The cost of your product will most likely include labor, the cost of materials, and manufacturing.

The cost of the car will comprise delivery charges and sales taxes. The product a person built is classified as inventory while the car is classified as a fixed asset. If you want to learn more about asset management, the website of the US General Services Administration offers the description of the Real Property Policy Division which supports and promotes government programs aimed to boost the efficiency of real estate management by federal agencies.

What Is the Difference Between Expenses and Costs?

These terms differ in three aspects: regularity, taxes, and accounting. Let’s have a closer look at all of them.

- Regularity. The term “cost” can usually be seen in business when talking about pricing methods and marketing. This is the sum paid to get or purchase something. It implies a one-time solution, such as a purchase. Expense is something more connected with taxes and the business balance sheet so it’s more formal. It can refer to ongoing payments, like marketing, payroll, rent, or utilities.

- Taxes. You need to take into consideration that taxes aren’t directly affected by costs. The cost of a certain asset is needed to define the depreciation business expense for every year. Expenses are deductible on the business tax return as they are utilized to gain profit. So, they can lower the income tax bill of the venture. Such expenses should be necessary and ordinary in order to be deductible.

- Accounting. The cost is often named cost basis in accounting and it comprises every cost to set up, deliver, or purchase the asset, as well as to provide employee training to use it.

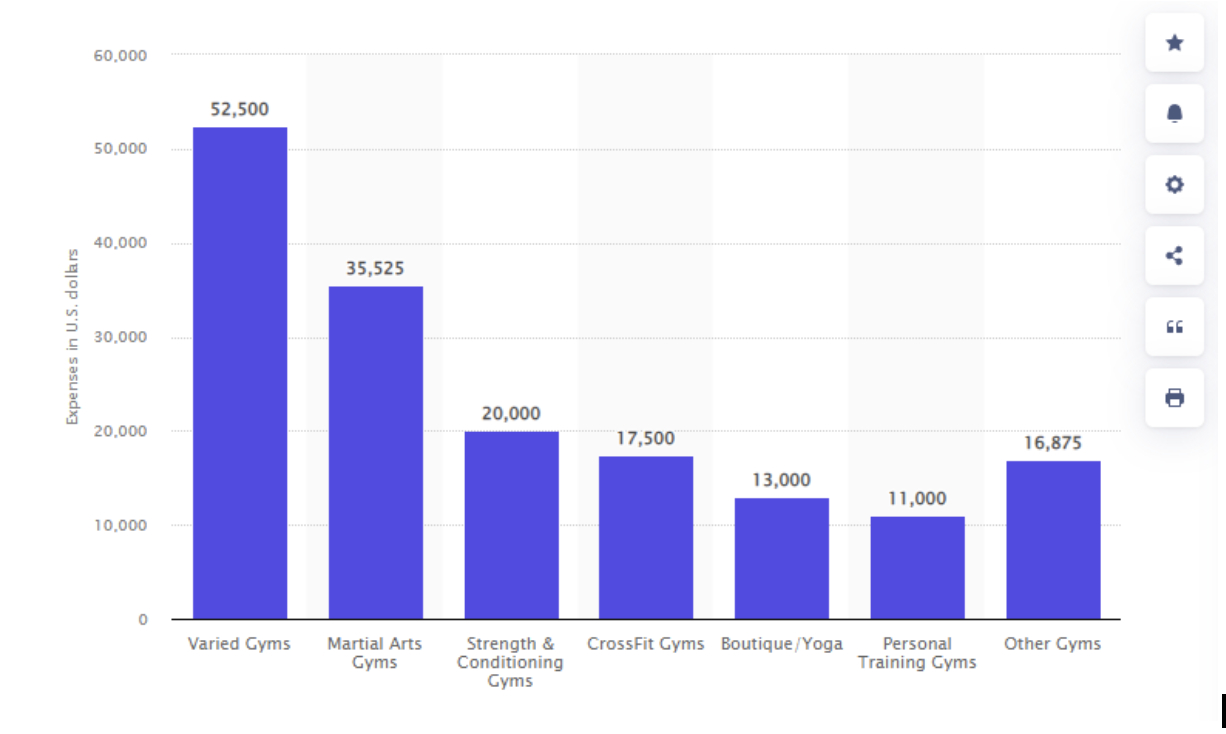

During a November 2020 survey among gym owners in the USA, it was estimated that varied gyms had 52.5 thousand dollars of expenses. Personal training gyms had only 11 thousand dollars in expenses on average.

When Expenses Should Be Used

Expenses can be considered as funds a person needs to spend to gain profit. You may consider the following expenses:

- Expenses to spend funds on utilities and rent

- Expenses to spend funds on a phone number to get in touch with clients

- Expenses to spend funds on advertisement

- Expenses to spend funds on a website to reach out to more clients.

When Costs Should Be Used

Costs may be variable and fixed. They generally refer to the price paid to a seller or producer for a particular product. Besides, they may be indirect and direct. Indirect costs comprise pay for warehouse or factory, storage needs, and labor. Direct costs comprise raw materials to manufacture products, items purchased for resale, inventory of finished goods, shipping and packaging items to clients.

The Bottom Line

Summing up, expenses and costs are similar terms and may even be utilized interchangeably. However, there are certain differences which are important for business owners.